Discover the power of Compound Interest and a way to use it to grow your wealth, plan for retirement, & reap long-term monetary dreams. Learn key strategies, common mistakes to keep away from, & how

compound interest can paintings for or in opposition to you.

What is Compound Interest?

Compound interest is one of the most effective monetary-concepts in the world. It refers back to the hobby earned on each the initial major quantity and the hobby that has already been introduced to it. Unlike easy hobby, which only applies to the unique amount invested or borrowed, Compound Interest allows your cash to grow exponentially over the years as the interest itself earns hobby. This compounding effect hurries up the increase of an investment or debt, making it critical for all of us concerned in saving, making an investment, or borrowing to recognize.

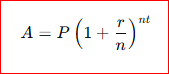

The Compound Interest formula may be damaged down as:

Where:

- A is the amount of cash amassed after n years, together with interest.

- P is the predominant amount (the initial amount of money).

- R is the annual hobby fee (decimal form).

- N is the quantity of times that hobby is compounded according to yr.

- T is the time the money is invested or borrowed for, in years.

The beauty of Compound Interest lies in its capability to snowball your wealth over time. In essence, the longer you go away your funding untouched, the more the impact of compounding. This exponential boom is what makes Compound Interest such a strong tool for wealth-constructing.

Understanding the fundamentals of Compound Interest is the first step in leveraging its capacity. While it can advantage savers, buyers, and even debtors, the secret is to start early and be strategic about how you operate it.

Key Components of Compound Interest

To sincerely maximize the electricity of compound hobby, it’s essential to apprehend its key components: most important, hobby rate, time, and compounding frequency. Each element plays a important function in figuring out how a lot compound interest will accumulate over time.

- Principal Amount: The main is the beginning amount of cash you make investments or save. This is the base on which hobby can be calculated. The higher your initial principal, the more hobby you will earn, and the larger the amount will grow because of compounding.

- Interest Rate: The hobby rate is the proportion at which your cash grows. A higher hobby rate leads to greater sizeable returns through the years. It’s critical to keep round for the nice costs, whether you’re saving, investing, or casting off a loan. Even small variations in hobby fees can cause great differences in the amount of cash amassed thru compound hobby.

- Time Period: Time is the most influential element when it comes to compound interest. The longer the cash is left to grow, the extra hobby it will collect. In fact, time has an exponential effect for your returns. Compound interest works high-quality while it has the possibility to paintings over a long period, making it critical to begin saving or making an investment as early as viable.

- Frequency of Compounding: Interest can be compounded at extraordinary durations: yearly, semi-yearly, quarterly, monthly, or every day. The greater frequently hobby is compounded, the extra the effect it has on the general growth of your funding. For instance, day by day compounding effects in greater common accumulation of interest compared to annual compounding, and hence, extra growth over the years.

By knowledge and strategically coping with these components, you could successfully harness the overall energy of compound interest and maximize your returns.

How Compound Interest Works

To absolutely grasp the strength of compound interest, it’s crucial to recognize the way it works. At its middle, compound interest grows your funding by means of reinvesting the hobby it generates, creating a cycle of growth that speeds up over the years.

In the first 12 months of an funding, hobby is calculated primarily based on the initial predominant. However, in the 2d 12 months, hobby is calculated on the unique main plus the hobby that become introduced in the first year. This way that each yr, the amount of hobby you earn will increase due to the fact the base amount (primary previously earned interest) will become large.

As you continue to allow the interest to compound, the increase of your investment begins to accelerate. The longer you depart your cash to compound, the greater reported this impact turns into. For example, an initial investment of $1,000 with a 5% annual hobby price compounded every year will yield $1,050 after the first year. After the second year, the hobby is calculated on $1,050, no longer simply the original $1,000. This system keeps 12 months after yr, developing exponential boom inside the investment’s cost.

The Power of Compounding Over Time

One of the maximum effective elements of Compound Interest is how it speeds up wealth over the years. This is why beginning early is so important. Even if you may only invest a small quantity to start with, the longer you go away that cash to compound, the bigger it will grow.

The Rule of 72 is a easy system that can help you apprehend how long it will take in your investment to double primarily based on a hard and fast hobby charge. To follow the Rule of 72, divide 72 by the once a year interest price. For example, if you invest at a 6% annual hobby fee, you could anticipate your funding to double in approximately 12 years (seventy two ÷ 6 = 12).

While the Rule of 72 gives a rough estimate, the real time can also vary slightly depending at the frequency of compounding. Nevertheless, this easy rule illustrates how compound interest can result in widespread wealth-constructing over time. The earlier you start investing, the greater time your money has to grow, and the greater big the compounding effect.

Compound Interest vs. Simple Interest

It’s crucial to differentiate between compound interest and simple interest. Simple hobby is calculated handiest on the essential quantity, meaning you do not earn hobby at the interest. For example, if you make investments $1,000 at five% easy hobby for three hundred and sixty five days, you may earn $50 in interest. However, with compound hobby, the interest earned in the first year is added to the predominant, and the second 12 months’ interest is calculated on the brand new total.

The exponential increase of Compound Interest can result in a whole lot better returns in comparison to easy interest, in particular over long intervals. This is why compound interest is frequently called the “8th wonder of the arena.” It really can paintings magic to your money when harnessed efficiently.

Maximizing the Benefits of Compound Interest

To absolutely take benefit of compound interest, it is critical to use positive strategies that allow your money to grow at its fullest capability. By that specialize in growing the primary, optimizing the hobby charge, reinvesting income, and making regular contributions, you can appreciably enhance the boom of your investments.

1. Increasing the Principal

The extra money you begin with, the bigger the bottom on which interest can accumulate. Increasing your preliminary funding is one of the best approaches to accelerate the growth of your savings or investments. Whether you’re saving for retirement or constructing an emergency fund, increasing the important as lots as viable will offer a larger foundation for compounding.

For example, if you have $1,000 earning 5% annual interest compounded annually, you’ll earn $50 within the first year. If you increase the essential to $5,000, you’ll earn $250 inside the first yr, and that quantity will retain to compound as properly. The large the preliminary investment, the extra you can benefit from the exponential growth that Compound Interest offers.

2. Optimizing the Interest Rate

While the most important is critical, the hobby fee performs a critical role in maximizing the power of compound interest. A higher hobby fee results in greater extensive returns through the years, and small differences in prices can bring about significant lengthy-time period results.

When deciding on investments, look for possibilities that offer the very best viable hobby rates. This may additionally contain taking a few risks, inclusive of making an investment in stocks or bonds, but with higher risk frequently comes the capability for better returns. If you’re unsure about your funding alternatives, speakme with a economic guide assist you to apprehend where to allocate your money for the excellent interest rate.

Moreover, you may additionally explore excessive-yield financial savings money owed or certificates of deposit (CDs) that offer higher charges than fashionable financial savings bills. In any case, that specialize in increasing the interest rate can dramatically speed up your compound interest boom.

3. Reinvesting Interest Earnings

One of the most powerful ways to maximize Compound Interest is by using reinvesting your income. Instead of chickening out your interest or dividends, reinvest them into the equal account or funding. This permits you to earn interest on the interest, which accelerates the compounding process.

In the context of investments such as shares or mutual funds, reinvested dividends can play a large role in building wealth through the years. For example, in case you very own dividend-paying stocks, you may get hold of a quarterly dividend payment. If you pick out to reinvest those dividends by using shopping extra shares, your investment grows faster than in case you clearly cashed out the dividends. The additional shares bought with the dividends will themselves earn dividends and capital profits, and the cycle keeps.

The key takeaway here is that after your earnings are reinvested, they can compound and create more extensive returns. Whether you’re dealing with a savings account, bonds, or fairness investments, reinvestment is a method you have to follow continually.

4. Making Regular Contributions

Another powerful strategy to maximize Compound Interest is by making ordinary contributions for your investment or savings account. Instead of making a one-time deposit, do not forget setting up a time table to make contributions small quantities consistently, whether monthly, quarterly, or yearly.

This is mainly useful for lengthy-time period dreams like retirement. Contributing to an IRA or 401(ok) consistently each 12 months, regardless of market situations, allows you to take gain of the compounding impact over time. For instance, if you invest $100 every month at an annual charge of 5%, compounded monthly, you’ll emerge as with considerably more than in case you most effective invested a lump sum at the start.

Regular contributions additionally allow you to gain from dollar-price averaging. This approach facilitates reduce the impact of brief-term marketplace fluctuations via buying investments at specific charge factors over the years. As a end result, your investments could have the ability to grow steadily whilst minimizing the threat of making bad funding alternatives primarily based on marketplace timing.

By often contributing in your financial savings or funding account, you increase the amount of cash on which hobby can compound, allowing for exponential increase.

Compound Interest in Savings Accounts

One of the maximum common packages of compound interest is in savings debts. The cash you deposit in a financial savings account earns hobby over time, and that interest is delivered to the balance of the account. In flip, future hobby is calculated primarily based on the new stability, which incorporates the previous hobby earned.

Banks provide numerous financial savings money owed with different compounding frequencies. Some bills compound interest daily, whilst others compound it month-to-month or yearly. The extra regularly your financial savings account compounds, the more you’ll advantage from compound hobby. For example, if an account compounds interest day by day in preference to yearly, your hobby could be calculated and brought in your balance every day, taking into consideration extra common compounding and in the long run better returns.

When deciding on a savings account, it’s essential to store round for the exceptional costs. Online banks frequently offer better interest quotes than conventional brick-and-mortar banks, and they will additionally offer each day compounding, which maximizes your ability earnings. Another thing to recall is any expenses associated with the account. High costs can erode your hobby profits, so make sure to choose a charge-unfastened or low-price account when feasible.

Another gain of Compound Interest in financial savings debts is that it allows you to save money effects. By putting in computerized deposits or transfers into your savings account, you could let your savings develop passively. Over time, this system builds a healthy economic cushion while taking advantage of the exponential boom of compound hobby.

Choosing the Right Bank for Maximum Yield

When the use of Compound Interest as part of your savings strategy, selecting the proper bank is essential for maximizing returns. The hobby rate, compounding frequency, and expenses all play a crucial position in figuring out how lots you’ll earn over the years.

Look for a financial savings account that gives a competitive interest charge. While a few percentage points may appear insignificant inside the brief term, over the years, they can make a vast difference. For example, an account that gives 2% interest may additionally seem similar to one which offers 1.5%, however over the long time, the 2% account will generate extra profits because of compound hobby.

Additionally, take note of costs that might negate the impact of compounding. Monthly upkeep expenses, withdrawal expenses, or minimal stability necessities can chip away at your savings, making it harder to reap your economic desires. Opting for rate-free debts ensures which you’re no longer losing out to your hobby profits.

Compound Interest in Investments

Compound Interest performs a vital position no longer handiest in savings but also in investments. While financial savings bills offer a reliable way to advantage from compounding, making an investment in belongings like shares, bonds, real estate, and mutual budget can make bigger the impact of compound hobby, presenting substantially higher returns over the years.

1. Types of Investments That Benefit from Compound Interest

Various investment automobiles are designed to take gain of compound hobby, however some provide more potent compounding results than others. Here are some examples of investments wherein compound interest can paintings in your want:

- Stocks: Stocks provide the capacity for capital appreciation (growing inventory fees) and dividends (periodic bills from groups to their shareholders). The dividends can be reinvested, which permits Compound Interest to work its magic. When dividends are reinvested, you’re essentially buying more stocks, which in turn can lead to greater dividends and similarly capital gains.

- Bonds: Bonds are a famous shape of fixed-profits investment, where you lend money to an entity in exchange for interest bills. While the hobby bills on bonds are typically no longer reinvested robotically like dividends, if you pick out to reinvest bond coupons, you could take full advantage of compound hobby. This is specially real for lengthy-term bonds that may provide consistent returns over time.

- Real Estate: Real estate investments can benefit from compound interest in multiple methods. In addition to condominium earnings, real estate residences often recognize in cost through the years. If you reinvest the profits from apartment income or assets sales, this reinvestment strategy permits you to leverage Compound Interest in a real estate portfolio. Moreover, real estate appreciates over time, presenting a further boom layer to your investments.

- Mutual Funds and ETFs: Mutual budget and exchange-traded price range (ETFs) are composed of a portfolio of assets which include stocks, bonds, or different securities. These funds regularly reinvest dividends, capital gains, and interest profits, making them a top notch way to capitalize on compound interest. By mechanically reinvesting profits, those finances can appreciably grow over the long term.

2. The Role of Dividends in Investment Growth

Dividends are one of the primary ways wherein investors can harness the energy of Compound Interest in stocks and different fairness-based investments. Many businesses distribute a component of their profits to shareholders inside the shape of dividends. Reinvesting those dividends returned into the stock or mutual fund permits you to purchase more shares, which then produce additional dividends. This creates a cycle of boom that can dramatically increase the cost of your portfolio.

For example, don’t forget a inventory that pays a 4% annual dividend. If you reinvest the ones dividends instead of taking them as cash, your holdings will steadily growth in price every yr, as the dividends themselves generate extra dividends. The longer you reinvest your dividends, the greater the compounding impact, making it a powerful device for building wealth over the years.

3. Risk Considerations

While compound interest is a effective tool for growing wealth, it’s vital to recognize that making an investment additionally entails risk. Higher-yield investments like shares, real property, or excessive-yield bonds come with a greater danger of loss, and marketplace fluctuations can effect your funding fee. Therefore, it’s critical to diversify your investments to mitigate hazard and make sure that your portfolio is balanced.

While Compound Interest is a excellent manner to grow wealth, it’s crucial to pick investments that align with your risk tolerance and lengthy-time period economic goals. By doing so, you can maximize the benefits of Compound Interest at the same time as preserving the best level of threat for your portfolio.

The Role of Taxes in Compound Interest

As powerful as Compound Interest is, it’s vital to understand that taxes can eat into your investment growth. The hobby earned on financial savings or investments is regularly issue to taxation, that can lessen the compounding effect. However, there are strategies to be had to decrease the impact of taxes on compound hobby, allowing you to retain more of your income.

1. Taxation on Interest Earned

In many cases, interest earned on financial savings debts, bonds, and other constant-profits investments is difficulty to income tax. Similarly, dividends earned from shares may also be taxed, even though the price depends on whether the dividends are qualified or non-qualified. If you’re in a higher tax bracket, the impact of taxes on compound interest may be good sized, slowing down the boom of your investments.

For example, if you earn $a hundred in interest in a year, and your tax fee is 25%, you would pay $25 in taxes, leaving you with most effective $75 to reinvest. This smaller amount reduces the bottom on which future hobby is calculated, leading to a less powerful compounding effect.

2. Strategies for Minimizing Tax Impact

There are several strategies you may use to limit the tax burden for your compound hobby:

Tax-Deferred Accounts: One of the quality approaches to reduce taxes on compound interest is by means of the use of tax-deferred bills like IRAs and 401(ok)s. With those sorts of money owed, you don’t pay taxes in your funding gains till you withdraw the funds, generally throughout retirement when your income can be lower. This gives your investments greater time to compound with out the drag of taxes.

Tax-Free Accounts: Roth IRAs, Roth 401(k)s, and different tax-advantaged debts permit you to invest money after-tax, but withdrawals are tax-loose if positive conditions are met. This way your compound interest grows without being taxed, offering great advantages over the years.

Municipal Bonds: In a few instances, municipal bonds may additionally offer tax-free interest. Municipal bonds are issued by using nearby governments, and their hobby is typically exempt from federal earnings taxes (and every so often country and nearby taxes, relying on your vicinity). If you’re seeking out a manner to gain from compound interest with out paying taxes, municipal bonds may be an fantastic option.

Tax-Efficient Investment Strategies: Another method is to use tax-efficient investment strategies, which include holding investments for longer intervals to gain from lengthy-time period capital profits tax prices (which can be frequently decrease than brief-term rates). Additionally, index budget and alternate-traded budget (ETFs) regularly have decrease turnover and generate fewer taxable occasions, that may help decrease the tax effect on compound interest.

3. How Taxes Can Limit the Growth of Compound Interest

Even with tax-advantaged techniques, taxes can nevertheless limit the boom of your investments over the years. The longer you permit compound interest to paintings, the extra suggested the impact of taxes turns into. The key to maximizing Compound Interest is to control your investments in a tax-green way, using the proper bills and techniques to reduce the tax drag on your returns.

To make the most of compound interest, it’s critical to element in the tax implications of your investments and financial savings. By planning your tax method cautiously, you can ensure that your wealth-constructing efforts aren’t hindered by means of needless tax burdens.

The Impact of Compound Interest on Debt

While Compound Interest is a effective device for growing wealth, it is able to have the opposite impact in relation to debt. When you owe cash, Compound Interest can work in opposition to you, mainly if you are sporting high-interest debt like credit card balances, non-public loans, or payday loans. Understanding how Compound Interest affects debt is critical, because it allows you to make knowledgeable decisions about borrowing and paying down your money owed.

1. Compound Interest on Loans and Credit Cards

When you borrow cash, compound interest is often implemented to the most important in addition to the accrued interest. This approach that if you have an amazing stability on a mortgage or credit card, hobby might be calculated no longer simplest on the amount you originally borrowed but additionally at the hobby that has been added for your stability. As a end result, your debt can grow rapidly, and it is able to take plenty longer to pay off than to start with expected.

For instance, permit’s say you have a credit card balance of $2,000 with an annual hobby price of 20%. After twelve months, you’ll owe $2,400—$2,000 in fundamental plus $four hundred in hobby. In the second 12 months, interest is calculated no longer just at the $2,000 main however additionally on the $400 in accumulated interest, so your debt will develop even quicker. If you continue to deliver that stability and handiest make minimal payments, the strength of Compound Interest can result in a debt spiral this is difficult to break out.

2. How Compound Interest Can Lead to Debt Spirals

Compound interest can fast flip plausible debt into an awesome financial burden. As your brilliant debt continues to accumulate interest, your bills may also slightly cover the hobby, not to mention the fundamental. This is particularly real with credit cards and payday loans, which regularly convey excessive-interest quotes.

When Compound Interest works towards you, it could grow to be very difficult to repay your balance. Even in case you make constant payments, the hobby collected can save you you from making meaningful development towards paying off the original debt. This can result in a cycle where you feel such as you’re paying off debt but by no means making sizeable headway.

For instance, if you owe $five,000 on a credit card with a 25% APR, and you simplest make the minimal month-to-month payments, it may take years to pay off the stability—and in the manner, you would possibly pay greater than double the original amount in hobby charges. This highlights the significance of paying off high-hobby debt as quickly as feasible to keep away from the poor consequences of compound interest.

3. Strategies to Minimize the Impact of Compound Interest on Debt

While compound interest can expand debt, there are strategies you can employ to reduce its impact and pay off your debt more effectively.

- Pay More Than the Minimum Payment: One of the most effective approaches to reduce the negative impact of compound interest on debt is to make bills above the minimum required quantity. The minimal fee on a credit card normally handiest covers the interest, leaving the major balance in large part untouched. By paying more than the minimal, you reduce the quantity of hobby that compounds, permitting you to repay the principal greater fast.

- Pay Off High-Interest Debt First: If you have more than one money owed, prioritize paying off people with the best hobby fees. This technique, called the debt avalanche approach, helps you decrease the whole quantity of interest paid and hastens the procedure of paying off your debt.

- Consider Debt Consolidation or Refinancing: If you have got a couple of high-hobby debts, consolidating them into a single mortgage with a lower interest charge can lessen the effect of compound interest. This allows you to attention on paying off your debt extra speedy at the same time as saving cash on interest. Refinancing loans or credit score card balances at a lower interest fee is another choice that can help you reduce the value of borrowing and accelerate your debt compensation.

- Avoid Taking on New Debt: While repaying present debt, avoid taking on new debt that might further boom the interest burden. As you work to reduce your outstanding balances, it’s important to chorus from gathering additional debt that would delay your progress.

By using those strategies, you may lessen the negative outcomes of compound interest on your debt and regain control of your financial state of affairs.

The Benefits of Starting Early with Compound Interest

One of the key strategies for maximizing the energy of compound interest is to start as early as possible. The in advance you start saving or making an investment, the more time your money has to develop, and the extra big the consequences of compounding will be. In fact, beginning early could make a massive difference in the quantity of wealth you collect over your lifetime.

1. The Exponential Growth of Compound Interest Over Time

The biggest gain of beginning early is the sheer quantity of time your money has to grow. Compound Interest is a snowball impact, and the longer your cash has to compound, the extra the returns can be. The first few years of compounding would possibly seem small, however as time passes, the boom accelerates.

For instance, don’t forget individuals: person who starts saving $one hundred in line with month at age 25 and every other who starts at age 35. If each individuals save for 30 years and earn an average annual return of seven%, the individual that starts offevolved at 25 could have considerably more money by the time they attain retirement age. The person who started later has missed out on those first 10 years of compounding, which means that their money has had less time to grow exponentially.

The distinction may be dazzling. By beginning early, you provide yourself a miles more possibility to take advantage of compound hobby, resulting in a far large retirement financial savings balance.

2. Small Contributions, Big Impact Over Time

Even if you start with small contributions, the compounding effect will work for your prefer through the years. The secret’s consistency. By making everyday deposits into your savings or investment account, no matter how small, you’re giving your self the benefit of Compound Interest over time. The energy of compound interest lies within the reality that it really works continuously, and the greater time it has to paintings, the larger your returns could be.

For instance, in case you keep just $one hundred a month at a 6% annual return, after 20 years, you can accumulate over $40,000—no matter contributing only $24,000 of your own money. The remainder comes from the interest earned and compounded over the years. Starting early permits you to look those types of returns, even in case your initial contributions are modest.

3. Avoiding the Pitfalls of Waiting Too Long

On the flip facet, waiting too long to start saving or making an investment can cost you dearly. Even in case you’re on your 30s or 40s, there’s still time to gain from compound interest, but the longer you postpone, the less time your cash has to develop. By the time you reach retirement age, you could locate that you haven’t accrued enough wealth to stay simply with out counting on debt or social security.

Procrastination is certainly one of the most important boundaries to achieving monetary security. The in advance you start, the greater time your cash has to work, and the extra the effect of compound hobby. It’s critical to apprehend that the important thing to economic achievement isn’t always how a great deal you shop at first, however how long you allow your cash to grow through compound hobby.

Understanding the Power of Compound Interest for Retirement Planning

When it comes to making plans for retirement, compound interest is one of the maximum valuable tools to your economic arsenal. Whether you are using business enterprise-subsidized retirement accounts, person retirement money owed (IRAs), or different funding motors, the potential to allow your cash compound over many years is fundamental to constructing a significant retirement fund. The in advance you start contributing for your retirement savings, the more you can take gain of compound interest to stable your destiny.

1. The Role of Compound Interest in Retirement Accounts

Retirement bills like 401(ok)s and IRAs offer a tax-advantaged environment to your savings to develop. One of the most sizable blessings of those money owed is that they allow your investments to compound over time with out being taxed on the earnings till you withdraw the budget (in the case of conventional 401(k)s and IRAs). This allows your cash to develop quicker than in a taxable account, as you’re no longer losing a portion of your returns to taxes every yr.

For instance, if you make a contribution $500 each month to a 401(okay) and earn an average annual go back of seven%, your contributions may be compounded through the years. By the time you attain retirement age, the entire value of your 401(k) will be numerous times higher than what you initially invested, thanks to the power of compound hobby. The longer you make a contribution and the more time your investments ought to grow, the bigger your retirement savings will be.

2. Compound Interest: The Key to Achieving Financial Independence

For many, the purpose of retirement planning isn’t always simply to retire at a certain age—it’s to achieve monetary independence. Financial independence permits you to live to your phrases with out counting on a paycheck. The key to reaching financial independence is often having investments that develop significantly through the years, and Compound Interest is the riding pressure in the back of this growth.

Imagine you start making an investment $300 a month in a retirement account at the age of 25, and by the time you are 65, your portfolio has grown due to compounding returns at a median annual charge of eight%. Over 40 years, you’ll have invested $a hundred and forty four,000, however your account balance might be worth over $1.1 million, way to compound hobby. This is how small, consistent contributions can create good sized wealth over time.

Starting early offers you the most enormous advantage because the earlier you start, the less you have to make a contribution to attain your retirement desires. Compounding takes time to construct momentum, but once it does, the results are exponential. The secret is starting early and being regular.

3. Compounding in Target-Date Funds

For retirement savers who want a hands-off approach, goal-date funds are a famous preference. These finances mechanically modify the asset allocation (mix of stocks, bonds, and coins) as you approach your target retirement date. They offer a easy way for investors to permit their cash develop thru compound interest while not having to fear approximately continuously rebalancing their portfolio.

Target-date finances are ideal for lengthy-time period retirement making plans due to the fact they allow you to start investing with minimum effort, and the compounding effect works inside the heritage as your money grows. You can set it and overlook it, understanding that the fund’s asset allocation will shift to become more conservative as you near retirement. This ensures that you are nevertheless taking advantage of compound interest all through your more youthful years even as defensive your portfolio as you age.

The Psychological Power of Compound Interest

While Compound Interest is frequently discussed in terms of numbers, it’s additionally vital to apprehend its mental effect. The idea of allowing your cash to grow over time can be tough to understand, mainly within the short term when the effects aren’t right now visible. However, developing a protracted-term mind-set about cash and investing is critical to maximizing the power of compound interest.

1. Patience and Consistency: The Key to Unlocking Compound Interest

One of the important thing mental obstacles to cashing in on Compound Interest is impatience. Many humans expect to peer consequences quick and grow to be discouraged while their investment doesn’t grow as hastily as they wish. The fact is that compound interest works slowly before everything but hurries up over time. It’s important to stay affected person and allow your investments to grow over a few years or even a long time.

The earlier you begin and the extra always you make a contribution, the extra you’ll gain from compounding in the long run. Those who’re inclined to stick with their financial plan and keep away from the temptation to coins out early or make impulsive selections are more likely to see the exponential outcomes of compound interest.

2. The Power of Small Investments Over Time

A commonplace misconception is that you need to invest large sums of cash to advantage from Compound Interest. However, even small, ordinary contributions may have a enormous effect over time. It’s often better to invest continuously and start early, even if the contributions are small. Compound interest builds through the years, and small quantities can grow into great sums while given enough time to compound.

For example, contributing simply $one hundred in line with month to an investment that earns 6% yearly will bring about over $100,000 after 30 years, in spite of handiest contributing $36,000 in general. The increase comes from the hobby earned on the interest itself, no longer just the preliminary funding.

3. The Mindset Shift: Viewing Money as a Long-Term Tool

To completely include the strength of compound interest, it’s crucial to view money as a device for long-term wealth-building in preference to short-time period spending. This mindset shift can appreciably affect your capacity to harness the entire capacity of compound interest. Viewing cash as some thing that grows through the years, instead of some thing to be spent right now, encourages saving and investing, which in turn allows your wealth to develop exponentially.

Compound interest isn’t just a mathematical concept—it’s also a attitude. Those who prioritize lengthy-term savings, invest early, and withstand the urge to spend unexpectedly can take full advantage of the increase that Compound Interest gives.

Conclusion

Compound Interest is a cornerstone of powerful financial planning. It holds the potential to noticeably boost up the boom of your savings and investments, provided you apprehend the way to harness its power. Whether you are saving for retirement, developing your investment portfolio, or dealing with debt, compound interest can paintings for your prefer—reworking small, constant moves into huge financial profits over time.

The key to maximizing the blessings of compound interest lies in starting early, being affected person, and making knowledgeable economic selections. By taking a proactive technique to saving and investing, you permit your cash to grow exponentially, providing you with the opportunity to build wealth for the destiny.

On the flip side, if you’re dealing with debt, it’s essential to recognize how Compound Interest can paintings in opposition to you. Understanding how hobby compounds on borrowed cash will let you control and pay off debt extra correctly. With careful strategies, you could mitigate its poor outcomes and regain manage over your finances.

Ultimately, Compound Interest is greater than just a monetary idea—it’s a method for long-term success. Embrace it, use it in your gain, and you’ll see your economic desires come to fruition faster than you ever imagined. The earlier you start, the extra effective this device becomes, putting you on a course to greater economic freedom and security.

FAQ’s

1. How Does Compound Interest Differ From Simple Interest?

Understanding the difference among compound and simple interest is critical whilst managing your budget. Simple hobby is straightforward: it’s calculated most effective on the principal, or initial amount invested or borrowed. For example, if you make investments $1,000 at an hobby rate of five% for three hundred and sixty five days, you’ll earn $50 in interest (1,000 * 0.05).

On the other hand, Compound Interest is interest calculated on each the foremost and the accrued interest. This manner that as time is going on, the hobby you earn (or owe) compounds and grows exponentially. The longer you leave your money invested or the longer you carry debt, the more powerful the compounding effect will become.

For example, if you invest $1,000 at five% compound interest, after 12 months, you’ll earn $50 in interest (just like simple hobby). However, inside the second yr, the interest is calculated on $1,050 (the principal plus the preceding year’s hobby), that means you would earn $52.50, now not $50. Over multiple years, this compounding impact accelerates the boom of your funding.

The key distinction is that compound interest permits your cash to grow faster due to the fact hobby is earned on the interest itself. Whether you’re making an investment for the long time or saving for unique financial desires, compound interest performs a widespread role in maximizing your returns.

2. How Can Compound Interest Help Me Achieve My Long-Term Financial Goals?

Compound Interest is one of the handiest gear for attaining long-term financial goals, which include building a retirement fund or saving for a massive purchase. Its electricity lies inside the way it hastens wealth accumulation over the years. But how exactly does this paintings, and how are you going to leverage it to meet your economic targets?

To maximize compound hobby, the key’s starting early and contributing consistently. The earlier you start, the extra time your money has to compound. The longer the funding period, the greater the consequences of compounding. For example, if you invest $one hundred a month beginning at age 25, by the point you reach 65, the cash may want to have grown extensively, even in case you didn’t growth your contributions. This is because compound interest maintains to construct on itself.

Consider your retirement savings. If you begin saving for your 20s or 30s and allow your contributions to compound over several decades, you’re setting your self up for financial security. For example, saving $500 a month with an annual return of 6% could result in over $700,000 by the time you retire, way to the compounding impact.

The regular, small investments over the years permit the strength of compounding to take over, turning what might seem like a modest contribution into enormous wealth via the stop of the accumulation duration. Whether your aim is monetary independence, buying a home, or investment training, compound interest makes the journey more achievable and much less reliant on big, one-time contributions.

3. Is It Too Late to Benefit from Compound Interest If I’m Already in My 30s or 40s?

Many humans worry that it’s too overdue to advantage from compound interest in the event that they haven’t started out saving or investing earlier in lifestyles. While it’s proper that the sooner you start, the more time your cash has to develop, it’s by no means too overdue to start reaping the rewards of compound hobby. Starting to your 30s or 40s nonetheless offers lots of time in your investments to develop substantially.

The secret is to make strategic monetary choices now that prioritize regular contributions and take benefit of the time you’ve got left earlier than retirement. The power of compound interest remains at paintings, and starting now will help you maximize it.

Let’s say you’re on your 40s and decide to start contributing to a retirement account. If you make investments $500 consistent with month with a mean annual return of seven%, by the time you attain 65, your investment ought to grow to over $six hundred,000. While it could no longer be as a lot as in case you had commenced to your 20s, it’s nonetheless a vast sum, and each 12 months you put off reduces the compounded boom.

Moreover, in case you’re for your 30s or 40s, your funding portfolio can also have the gain of being large than it’d had been if you began later, mainly if you can ramp up your contributions. You can nonetheless benefit from the lengthy-term consequences of compounding—simply with a greater focused, disciplined technique.

4. What Are Some Common Mistakes to Avoid When Using Compound Interest to Grow Wealth?

While compound interest can be an exceptionally powerful tool, it’s clean to make errors which could prevent your capacity to maximize its potential. Some not unusual mistakes that investors make consist of procrastinating, neglecting to reinvest income, and ignoring high-hobby debt. Let’s break them down.

Procrastination: One of the largest pitfalls is ready too long to begin investing. Even in case you begin in your 30s or 40s, you may nonetheless benefit from compound interest—however the earlier you begin, the more time you give your investments to grow. Starting small and constructing up over the years is better than by no means starting in any respect.

Not Reinvesting Earnings: Another mistake is not reinvesting the interest, dividends, or capital gains your investments generate. If you don’t reinvest these earnings, your money won’t compound effectively, and you could pass over out on tremendous boom over time. Make sure your investments are set up to reinvest earnings mechanically.

Ignoring High-Interest Debt: On the turn aspect, in case you’re wearing excessive-hobby debt, compound interest is operating towards you. High-hobby debt, such as credit score card balances or payday loans, grows quickly because of compounding, and can make it difficult to break out a debt spiral. It’s crucial to prioritize paying off excessive-interest money owed as fast as viable to save you Compound Interest from increasing your general debt.

By averting these errors and staying disciplined in your technique to saving and investing, you could allow Compound Interest to work for your gain, helping you reach your financial dreams quicker and with much less attempt.

5. Can Compound Interest Help Me Pay Off My Debt Faster?

While Compound Interest is frequently related to developing wealth, it is able to additionally be a beneficial tool with regards to paying off debt. However, you want to be aware about how it works in both instructions—each when it is helping you and when it’s running in opposition to you.

If you’re in debt, such as with credit playing cards or loans, compound interest is probable working against you, making it extra high priced to carry your debt through the years. The key to coping with compound interest in this example is to repay your debt as fast as possible to minimize the quantity of interest that accrues on your balances.

Here are some strategies to help you repay your debt more efficiently using the idea of compound hobby:

Pay More Than the Minimum Payment: By paying greater than the minimum required, you reduce the foremost balance extra quick, which in turn reduces the amount of hobby that compounds. The quicker you can decrease the primary, the less Compound Interest will acquire.

Focus on High-Interest Debt First: The debt with the highest hobby charge have to be your priority. By the use of the debt avalanche technique, you may focus on paying off high-hobby debt first, allowing you to reduce the overall interest payments and limit the compounding results.

Consider Debt Consolidation: If you have got multiple excessive-interest debts, consolidating them into one loan with a lower interest fee may want to assist reduce the overall amount of interest you pay over time. This can assist save you compound interest from developing your debt unnecessarily.

By dealing with your debt strategically and paying it off faster, you could reduce the poor effect of Compound Interest and ultimately attain monetary freedom more quickly. The goal is to permit compound interest help you develop your wealth rather than hinder your development due to growing debt.